A captive is a retention vehicle just like a deductible . Captives come in many sizes and

shapes. They are written in a domicile either in the country or offshore. The selection of a

domicile is based on a few different criteria. The Cost of administration of the captive, taxes,

overall regulations in the domicile. How much surplus must be posted to back the captive. Does

it need to be cash or LOC?

Reasons for the use of a captive Vs a deductible

1. Biggest reason is the client can’t find coverage in the standard or wholesale marketplace.

Eg Cannabis because it is federally illegal making it uninsurable besides using a captive

2. Next would come extreme volatility in the market based on availability and price. The

captive provides market stability

3. Tax advantages

4. Access to the Reinsurance Community

Pros and Cons of a captive

Pros

1. The accruals come off the company’s books and on to the captives’ financials.

2. Investment opportunities are better than in the commercial insurance marketplace

3. You can lend to foreign subs

4. Control of the claims and post claims management

5. You can adjust how much Reinsurance you need and buy

6. Tax advantage

Cons

1. It is much more expensive than a deductible

2. There is travel to do board meetings can be expensive

3. Private equity considers it a messy exit

4. In the some of the group captives their may be assessments of not only your own

business but from others bad performance of other captive members

Other interesting facts

1.Captives come in many types. A few of them would be ;

a. Group captive usually companies with similar risk profiles. There are tax advantages to

having more than one risk in the captive. All members of the captive share the expenses of the

captive

b. Single captive allows one company to own a retention vehicle and control market

availability, price , and access to the reinsurance community,

c. Rent a cell Similar to b. but without the costs of setting up your own company.

2. Where statutory coverages are being offered by the captive (Workmens Comp and Auto) a

fronting carrier will be used to issue the policies and pay the claims.

3. Have their own financials that need to be audited just like any other company

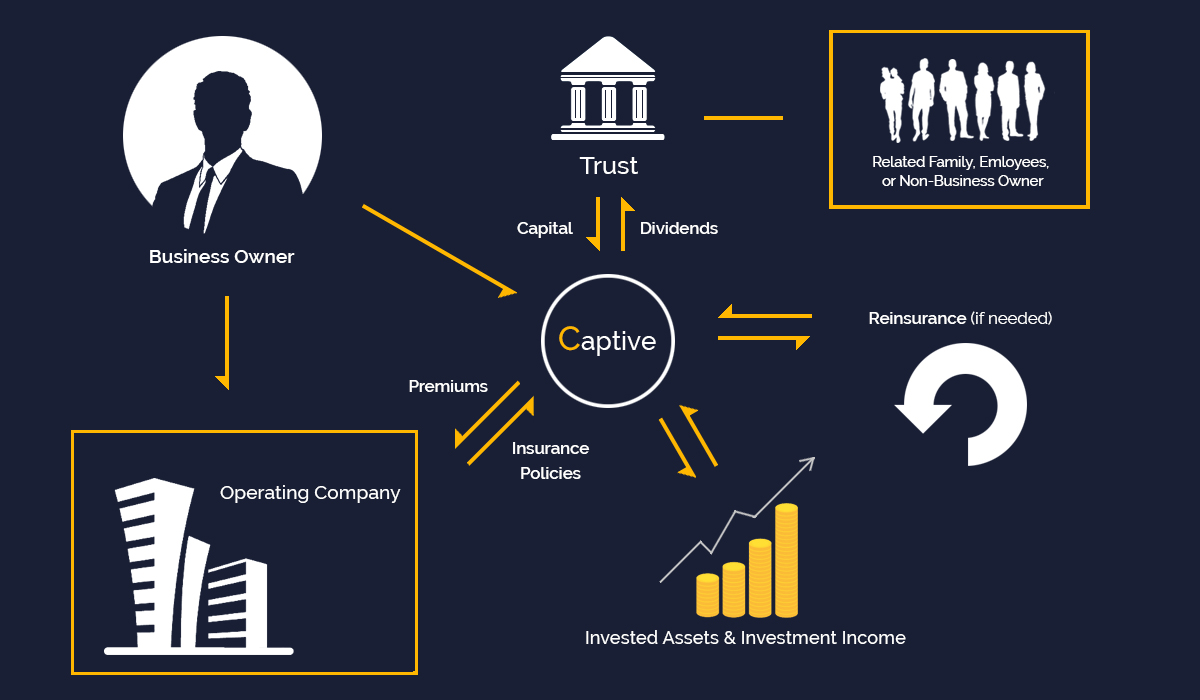

4. They can be used by business owners to expand coverage and perpetuate family wealth

';